Contents:

A really healthy current ratio would be about 2, to ensure your company will be able to pay current liabilities at any time and still have a buffer. Alongside this metric is the quick ratio which is similar to the current ratio except it takes into account only the near-cash assets, meaning all assets that you can convert into cash quickly such as equipment or furniture. This means your quick ratio will always be lower than your current ratio. By monitoring these metrics you can understand at a quick glance if your business is liquid or not.

- Besides, it’s difficult for your business to thrive without financial fluency and skills in data visualization.

- ChartExpo is an Excel add-in loaded with insightful and ready-to-go visualization charts, some of which you can use to visualize monthly financial reports.

- Alongside this metric is the quick ratio which is similar to the current ratio except it takes into account only the near-cash assets, meaning all assets that you can convert into cash quickly such as equipment or furniture.

- For instance, We can see that between the months of July and October, the perfect order rate saw a huge decrease, this can be complemented with the main return reasons to understand where the issue is.

In the overview, we can see that scatter plots and bubble plots will work best in depicting the relationship of the data while the column chart or histogram in the distribution of data. To learn more about a specific chart and details about each, we suggest you read our guide on the top 15 financial charts. Maintaining an efficient, productive work environment, and ensuring that you can identify any employee discrepancies or issues is critical to being proactive about business growth. Generally, costs should not be looked upon purely on the basis of black and white. If sales and marketing cause cost increment, maybe they also deliver high volumes of income so the balance is healthy, and not negative.

A robust finance report communicates crucial accounting information that covers a specified period through daily, weekly, and monthly financial reports. These are powerful tools that you can apply to increase internal business performance. A data-driven finance report is also an effective means of remaining updated with any significant progress or changes in the status of your finances and helps you measure your results, cash flow, and financial position.

Simple Monthly Report Template

Going a bit more in-depth with this sample we first get a glance at critical numbers such as revenue, profit, and costs. Each of them is compared to a set target as well as the performance of the previous month. Through this, you can easily understand if the business is reaching its goals and strategies are being successful. Next, the example provides a breakdown of the costs and revenue of different business departments for the month of march allowing you to closely monitor expenses and budgets. Paired with this, we see two charts displaying the NPS for employees and customers.

This will help ensure that you have time to work on the most important things, which will make it easier for you to complete them faster. You might have trouble prioritizing your tasks because you don’t know what to do. A monthly report can help with this because it gives you a better sense of how much time each task will take and where the money is going. Now, let’s discuss what’s the purpose of a monthly report and why you should create a monthly report and not just stick to a weekly or annual report. Create a business plan using Word with a companion Excel workbook for customizing financial statements.

Plans for the Next Month

It provides an overview of key statistics, information about the company’s financial position and a review of the performance of critical business units. Use this accessible annual financial report template to communicate your company’s year-over-year financials at a high level. Customize this financial report template by selecting specific key metrics to highlight. This example of a financial report is professionally designed and editable in Excel.

We live in a data-driven age, and the ability to use financial insights and metrics to your advantage will set you apart from the pack. We’ll take you through monthly financial report templates in the ensuing section. Also, you’ll learn the key types of financial reports that every business needs.

By now you should be aware of how creating interactive reports with the help of modern solutions can take your business reporting to the next level. Throughout this insightful article, we provided you with powerful reasons why you should implement monthly reporting in your business, and gave you a list of interactive examples including sales, finances, and marketing reports. If you want to take a look at other examples such as IT or Human Resources monthly reports browse our list of dashboard examples for several industries and functions. The left part of the dashboard displays a line chart for paying customers, lost, and churn rates. The goal here should be to keep your churn rate as low as possible with efficient strategies that need to closely be monitored and improved every month.

What Is A Financial Report?

The best report contains all data with your management team have to make decisions. To manage financial performance in comparison to a set target, you can also use a modern KPI scorecard. That way, you will not only monitor your performance but see where you stand against your goals and objectives. By defining the mission and audience, you will know how to formulate the information that you need to present, and how complex the jargon will be.

Quarterly financial report updates and Q&A – Department of Health

Quarterly financial report updates and Q&A.

Posted: Fri, 22 Jul 2022 07:00:00 GMT [source]

The dashboard also provides a breakdown of each of these metrics to analyze each element in detail. For instance, by looking at the past 6 months of the revenue breakdown chart we can see that this business has not been reaching the forecasted amount which means something might be going on that needs to be looked at. On the other hand, we can see that costs for marketing are slightly higher than expected which can also be something to look into and see if these costs are justified. Equipped with financial analytics software, you can easily produce these daily, weekly, monthly, and annual reports. They will provide your company with the insights it needs to remain profitable, meet objectives, evaluate your decision-making processes, and keep everyone in the value chain on track.

A Statement of Retained Earning

Your monthly report should be consistent with your branding regardless of its type. Use your company logo, brand colors, brand fonts and other branding elements. If you are ready to create a monthly report, use Visme’s online report maker. Choose a template and customize it in the Visme editor to make it your own. Financial Management Templates at templates.office.com – The new Microsoft Office® templates gallery has a few financial statements.

This insightful https://bookkeeping-reviews.com/ marketing report template is the perfect tool to test the success of your social media strategies as well as what type of content your target audience enjoys the most. Next, the SaaS dashboard provides a breakdown of the monthly recurring revenue . This is arguably one of the most relevant metrics to track for any SaaS business as they need to generate increased revenue to be able to grow.

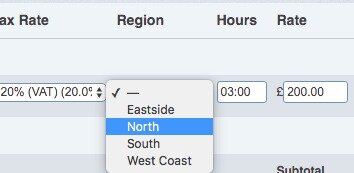

approve and authorize an expense claim in xero offers a wide range of charts and graphs templates that you can use and replace the pre-existing ones in this template. This template is for you if you are looking for a colorful, dynamic report to evaluate your business’s customer service. The template will help you highlight essential information with bright colors and timeless fonts. Once you have gathered all the data you need from the various departments, it’s time to analyze them.

Home Statistics Data collection Statistical Reporting – Bank of England

Home Statistics Data collection Statistical Reporting.

Posted: Thu, 01 Dec 2022 10:49:16 GMT [source]

Automation plays a vital role in today’s creation of company financial reports. With traditional reporting, automation within the application is not quite possible, and in those scenarios professionals usually lose a lot of time since each week, month, quarter, or year, the report needs to be created manually. Automation, on the other hand, enables users to focus on other tasks since the software updates the report automatically and leaves countless hours of free time that can be used for other important tasks. We will see a simple financial report sample created with automation in mind below in our article.

- Traditional means of reporting are tedious and time-consuming, it take hours or even days for a report to be completed and they usually require a lot of work from the IT department.

- After COVID-19 hit, e-commerce sales increased by a shocking $244 billion dollars which translates into a 43% growth.

- Your monthly report should be consistent with your branding regardless of its type.

- This information is broken down below into the responses of the different months, where we can see how the NPS increased a lot in the second half of the year, while the effort score decreased.

- In the last, the meeting ends all these products and items may link to the appropriate components.

- On the other side, the financial portion provides the necessary data to closely monitor and manage IT expenses.

By utilizing self service analytics tools, each professional in your team will be equipped to explore and generate insights on their own, without burdening other departments and saving countless working hours. Keeping your budget expectations and proposals as accurate and realistic as possible is critical to your company’s growth, which makes this metric an essential part of any business’s reporting toolkit. The quick ratio/acid test is worth tracking – by measuring these particular metrics, you’ll be able to understand whether your company is scalable, and if not – which measures you need to take to foster growth. The data visualization software makes communicating your custom charts and graphs effortless.